The Financial Transformation of a Global System: Ethereum's Role as a Digital Backbone

Author: Tin Chung - Elastic Labs

Summary

At the time of writing, the total cryptocurrency market capitalization has reached $4.3 trillion (one sixth the marketcap of Gold), with Bitcoin trading at $116,000 and Ethereum at $4,600. These milestones underscore a historic transformation underway in the global financial system.

For over a century, financial infrastructure has been dominated by centralized institutions—banks, governments, and payment networks. Today, that paradigm is being challenged as decentralized technologies like Ethereum emerge as the foundation of a new digital economy.

While the current financial infrastructure has empowered trillion transactions across the globe in the past centuries, there are a lot of inefficiencies and huge barriers for entry and systematic risks. Hence, Ethereum from an ascent project turns into the robust infrastructure for the upcoming financial innovations and daily asset transfers.

The Origin of Ethereum

To grasp the long-term value of Ethereum, it’s essential to first understand why it was created. While Bitcoin established itself as a “store of value” or “digital gold,” Ethereum emerged with a broader vision.

Rather than focusing on a single monetary use case like its predecessor, Ethereum was designed as a programmable blockchain — a platform where anyone can build and launch new financial technologies with minimal barriers to entry.

This critical distinction lies in its ability to execute automated, self-executing smart contracts, which function as digital agreements that run independently once deployed.

This capability is the fundamental engine altering the very economics of finance, offering a new "Internet of Value" where money, credit, ownership, and trust are created and managed by code rather than by traditional institutions. The transformation is so significant that it threatens to shift value away from legacy intermediaries and toward open, programmable networks, making finance more competitive, transparent, and borderless for all participants.

Last Decade of Innovations on Ethereum (2014 - 2024)

The first decentralized exchange

Was introduced initially as a smart contract application on Bitcoin but adopted widely on Ethereum, proving the core value of Ethereum as the “programmabe blockchain”. The concept of a decentralized exchange (DEX) emerged from the same motivation that led to the creation of Bitcoin and Ethereum: removing reliance on centralized intermediaries. Unlike centralized exchanges (CEXs), which custody user funds and act as trusted third parties, DEXs allow peer-to-peer trading directly on the blockchain through smart contracts.

Decentralized exchange nowadays are no longer a rare concept, and we have seen thousands of Automated Market Makers (AMMs) operated and secured user’s fund in a decentralized way across the globe. Most common one can be named like Uniswap, KyberSwap, CoW Swap…

But the early history of decentralized exchange on blockchain was not originally AMMs:

Bitcoin-based protocols (2014–2015): The first attempts at decentralized trading were built on Bitcoin. Projects like Counterparty and Bisq introduced ways to exchange assets without relying on centralized order books, but adoption was limited by Bitcoin’s scripting constraints and low throughput.

EtherDelta (2016–2017): Widely recognized as the first Ethereum-based DEX, EtherDelta allowed users to trade ERC-20 tokens through smart contracts. It was revolutionary in proving that an exchange could run entirely on-chain. However, EtherDelta relied on an order book system, which made it slow, clunky, and expensive during periods of high gas fees.

Evolution of DEXs

As outlined in the introduction, the traditional financial system we rely on for everyday payments has never been flawless.

Centralized trust: Financial services depend on intermediaries—clearing houses, correspondent banks, custodians—each introducing friction, costs, and counterparty risk.

Limited accessibility: Billions remain underbanked or entirely excluded due to geography, regulatory barriers, or high fees.

Slow innovation cycle: Legacy rails such as SWIFT, ACH, and card networks evolve at a glacial pace, constrained by decades-old infrastructure.

The 2008 financial crisis highlighted the fragility of this architecture, sparking demand for decentralized alternatives.

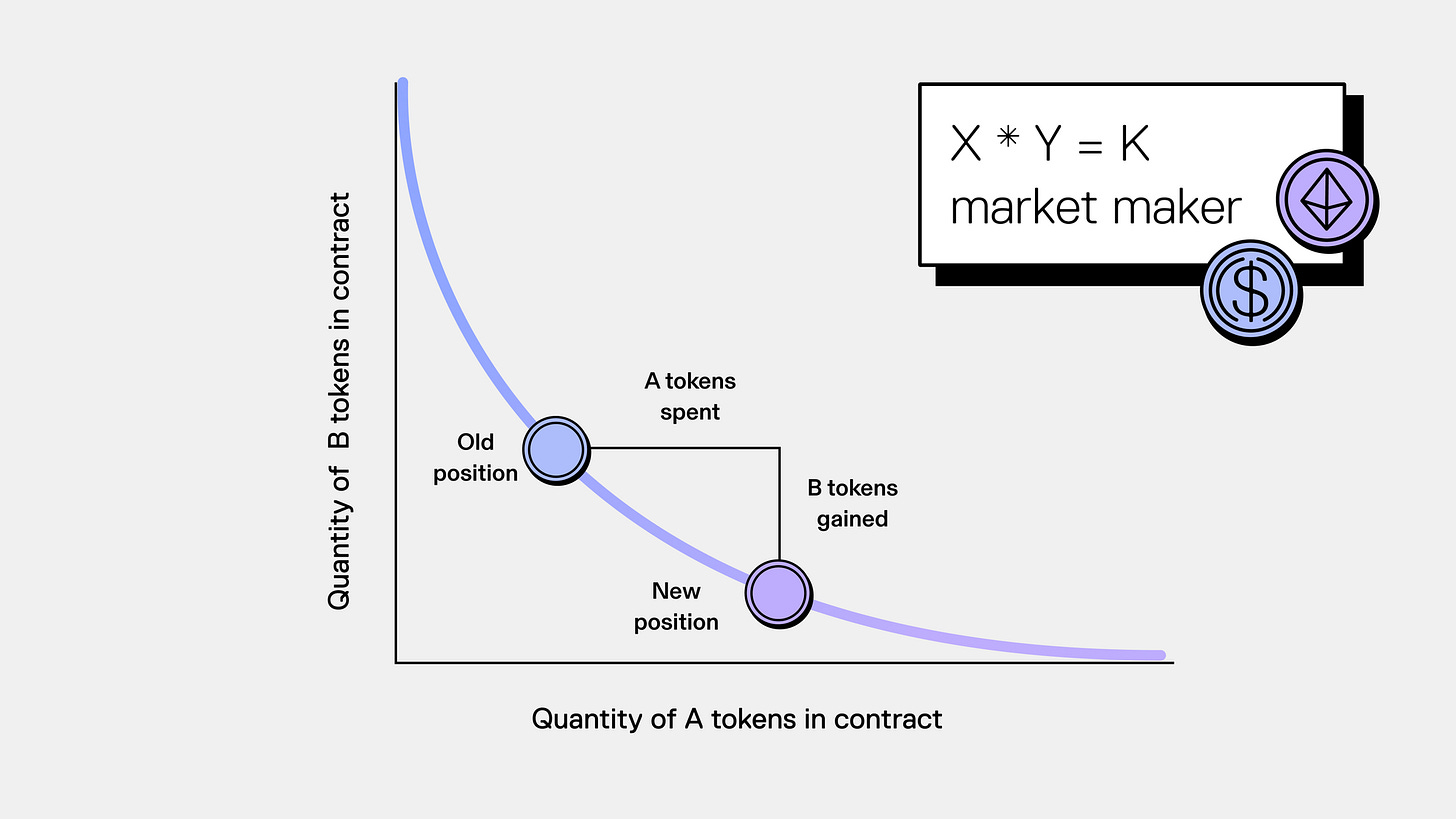

The breakthrough came with Uniswap (2018), which introduced the Automated Market Maker (AMM) model. Instead of using an order book, AMMs rely on liquidity pools and algorithms to determine prices. This dramatically improved user experience and liquidity efficiency, kicking off the modern era of DEXs.

From order books to pools: Traditional exchanges rely on buyers and sellers placing orders. Uniswap replaced this with liquidity pools where anyone could deposit assets, and an algorithm determined the price dynamically.

Open participation: Instead of relying on professional market makers, anyone could become a liquidity provider and earn fees.

Improved efficiency: By abstracting away order books, AMMs made trading smoother, especially for long-tail assets with limited demand.

This model revolutionized the user experience of decentralized exchanges (DEXs). No more waiting for counterparties, no intermediaries—just instant swaps directly on-chain. The success of Uniswap sparked an explosion of innovation: DEXs became the backbone of DeFi, liquidity provision turned into a global yield opportunity, and Ethereum cemented its position as the digital backbone of programmable finance.

The Merge: From “Proof of Work” to “Proof of Stake”

Ethereum’s ability to serve as a foundational financial layer is rooted in its innovative technical and economic architecture. A pivotal moment in this evolution was "The Merge" in 2022, when the network transitioned from a competitive, energy-intensive Proof-of-Work (PoW) consensus mechanism to a more sustainable Proof-of-Stake (PoS) system.

Originally, "the Merge" referred to the most important event in the Ethereum protocol's history since its launch: the long-awaited and hard-earned transition from proof of work to proof of stake. - Vitalik Buterin, Possible futures of the Ethereum protocol, part 1: The Merge

In the PoS model, network participants known as "validators" are chosen to create new blocks and confirm transactions based on the amount of cryptocurrency they "stake" as collateral. To run a solo validator node, a user must stake a minimum of 32 ETH, though staking pools and centralized platforms allow for participation with much smaller amounts, thereby lowering the barrier to entry.

This new economic structure is not just a technical curiosity; it addresses a major barrier to the adoption of digital assets by professional investors. For a long time, traditional finance struggled to apply its familiar valuation frameworks to a purely speculative asset like ETH. The shift to a yield-bearing asset that generates cash flow from network activity changes that equation entirely. The ability to earn a staking yield of around 3% annually, coupled with the potential for a deflationary supply , allows professional investors to analyze ETH using time-honored valuation models, such as discounted cash flow. This fundamental transformation bridges a critical conceptual gap, making Ethereum a more comprehensible and attractive asset for institutional strategies focused on long-term value creation.

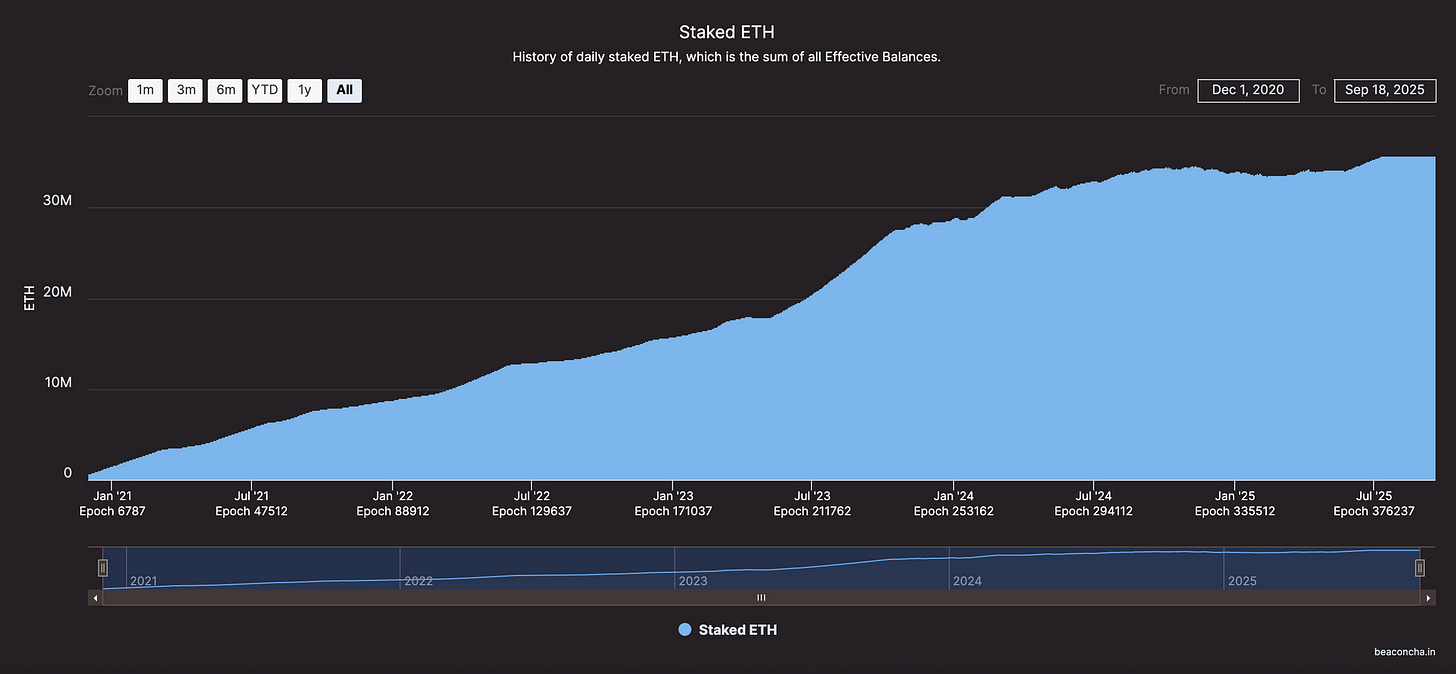

As shown in the beaconcha.inStaked ETH Chart - Open Source Ethereum Blockchain Explorer …, since The Merge —which transitioned Ethereum’s Mainnet from Proof of Work to Proof of Stake — the amount of staked ETH has grown steadily. This sustained growth highlights the broader adoption of Ethereum’s model within the global economy.

Layer 2 brings Ethereum closer to institutions

Also fall into the protocol-level breakthroughs, if Proof Of Stake opened a new window for Ethereum in the consensus mechanism and the economic model, Ethereum's mainnet (Layer 1) has historically faced significant scalability challenges, leading to network congestion, slow transaction times, and prohibitively high fees, or "gas fees," during periods of high demand.

These limitations have been a major impediment to its widespread adoption for microtransactions and large-scale enterprise applications. The solution has been a focus on developing Layer-2 (L2) solutions, which are built on top of the main blockchain to handle transactions off-chain while still leveraging Ethereum's core security.

In this article, we don’t mention much about the underlying infrastructure of the Layer 2, but there are some valuable articles from Vitalik

By moving transaction execution off the Ethereum mainnet while anchoring security and finality back to Layer 1, L2s unlock the kind of performance institutions expect from global financial infrastructure.

Scalability at institutional grade: Rollups—whether Optimistic or Zero-Knowledge (ZK)—are now capable of handling thousands of transactions per second, reducing settlement times from minutes to seconds.

Predictable, lower costs: With batching and compression, transaction fees on L2s can be magnitudes cheaper than L1 Ethereum. This makes microtransactions, high-frequency trading, and complex financial instruments economically viable.

Customizable environments: Application-specific rollups and modular execution layers allow financial institutions to design settlement systems tailored to their needs while still inheriting Ethereum’s security.

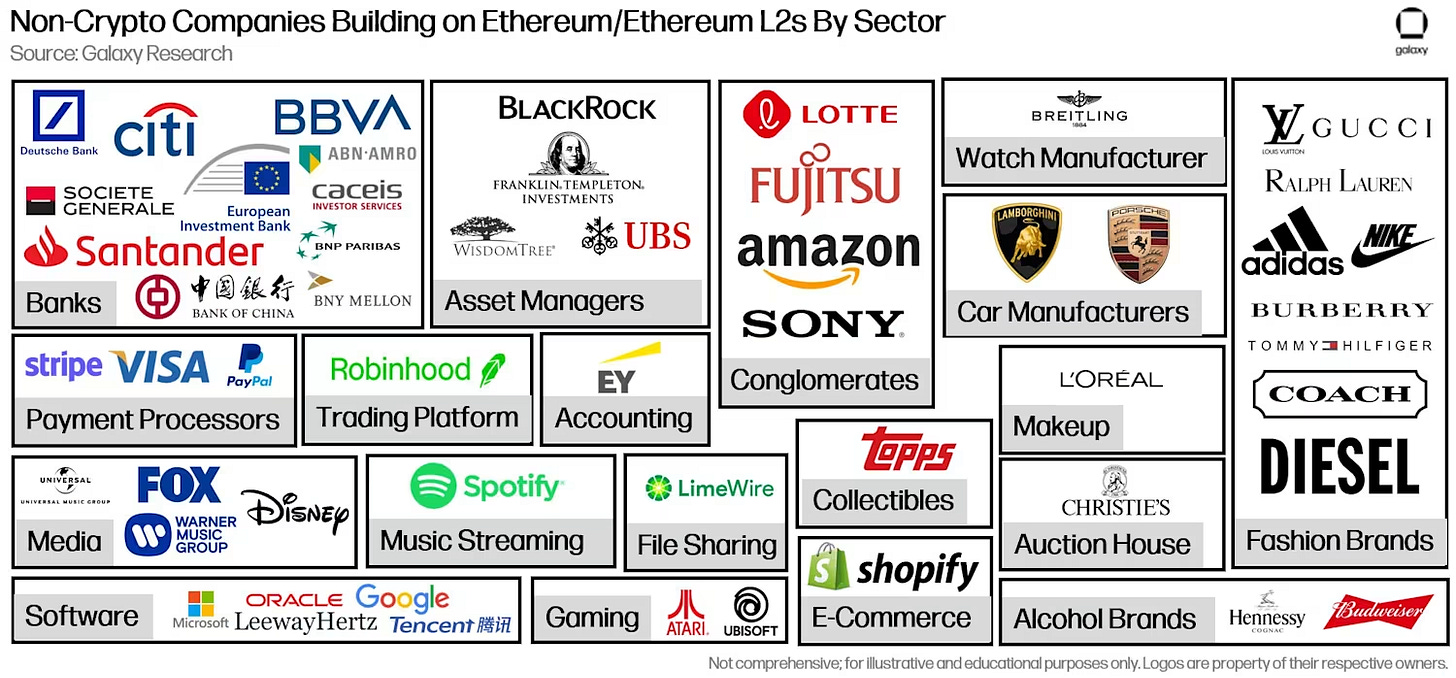

We are already seeing the results:

JPMorgan has piloted tokenized bond transactions on Ethereum-based networks.

BlackRock launched its tokenized money market fund on Ethereum, settling billions of dollars in assets.

Visa has experimented with stablecoin settlement on Ethereum and L2s, citing efficiency gains.

Not only that, top crypto-native companies also decided to build a Layer 2 on Ethereum:

https://www.linkedin.com/pulse/robinhoods-l2-just-beginning-six-key-drivers-rollup-boom-gogol-ndske

https://help.coinbase.com/en/coinbase/other-topics/other/base

https://www.optimism.io/blog/welcoming-ink-to-the-superchain

For institutions, Layer 2 is the bridge between Ethereum’s open innovation and the requirements of enterprise-scale finance. It ensures that Ethereum can evolve from being a “sandbox for experimentation” into the backbone for global settlement, tokenized assets, and institutional-grade financial products.

Global Payment System with Stablecoin

“Our vision for Ethereum is the Infinite Garden. Ethereum is more than a technology, it is a diverse ecosystem of individuals and organizations that build and grow alongside a protocol. The Ethereum ecosystem wasn't something that was designed by any one individual or organization, but it organically evolved with the support of people who nurture the ecosystem to become more vibrant and diverse.” - Ethereum Foundation, Infinite Garden

With the rise of Layer 2 networks, Ethereum now hosts a diverse set of sub-ecosystems, each extending its scalability while ultimately reinforcing the value of the Ethereum mainnet.

At the heart of this shift is a reimagined global payment system, among these, one of the most significant names is Base—Coinbase’s Layer 2 built on top of Optimism—which is rapidly emerging as the leading infrastructure for stablecoin payments. For decades, cross-border transfers have been burdened by high fees, delays, and reliance on intermediaries. Ethereum’s programmable architecture is rewriting the rules by enabling fast, borderless, and low-cost settlements.

Stablecoins as a universal settlement layer: Assets such as USDC, USDT, and DAI already process billions of dollars in daily transactions. On Ethereum and its L2s, these stablecoins serve as the backbone of near-instant global payments. (CNBC report on stablecoin adoption)

24/7 availability: Unlike banks, which close on weekends and holidays, Ethereum-based payment networks operate continuously, in sync with a digital-first economy.

Borderless access: From entrepreneurs in Vietnam to freelancers in Nigeria to enterprises in the U.S., Ethereum enables equal participation in the same global payment rails.

Base exemplifies this evolution. Built with Optimism’s OP Stack, Base is optimized for payments at scale. With the introduction of Flashblocks, Base can process up to 200 million transactions per second, unlocking near-infinite capacity for stablecoin-driven commerce. (Base Flashblocks documentation)

On top of this infrastructure, new protocols are emerging to bridge payments with intelligent automation. One example is x402, an open standard designed for agent-to-agent financial interactions. Backed by initiatives from Google and the broader agentic commerce ecosystem, x402 enables payments to be embedded directly into AI-powered applications. (Google announcement, x402.org, GitHub)

Together, stablecoins, Base, and protocols like x402 point toward a future where Ethereum is not just the settlement layer for decentralized finance—it becomes the universal backbone for global payments, connecting people, businesses, and autonomous systems at planetary scale.