Tempo: Why Stripe and Paradigm Are Building a Blockchain Just for Payments

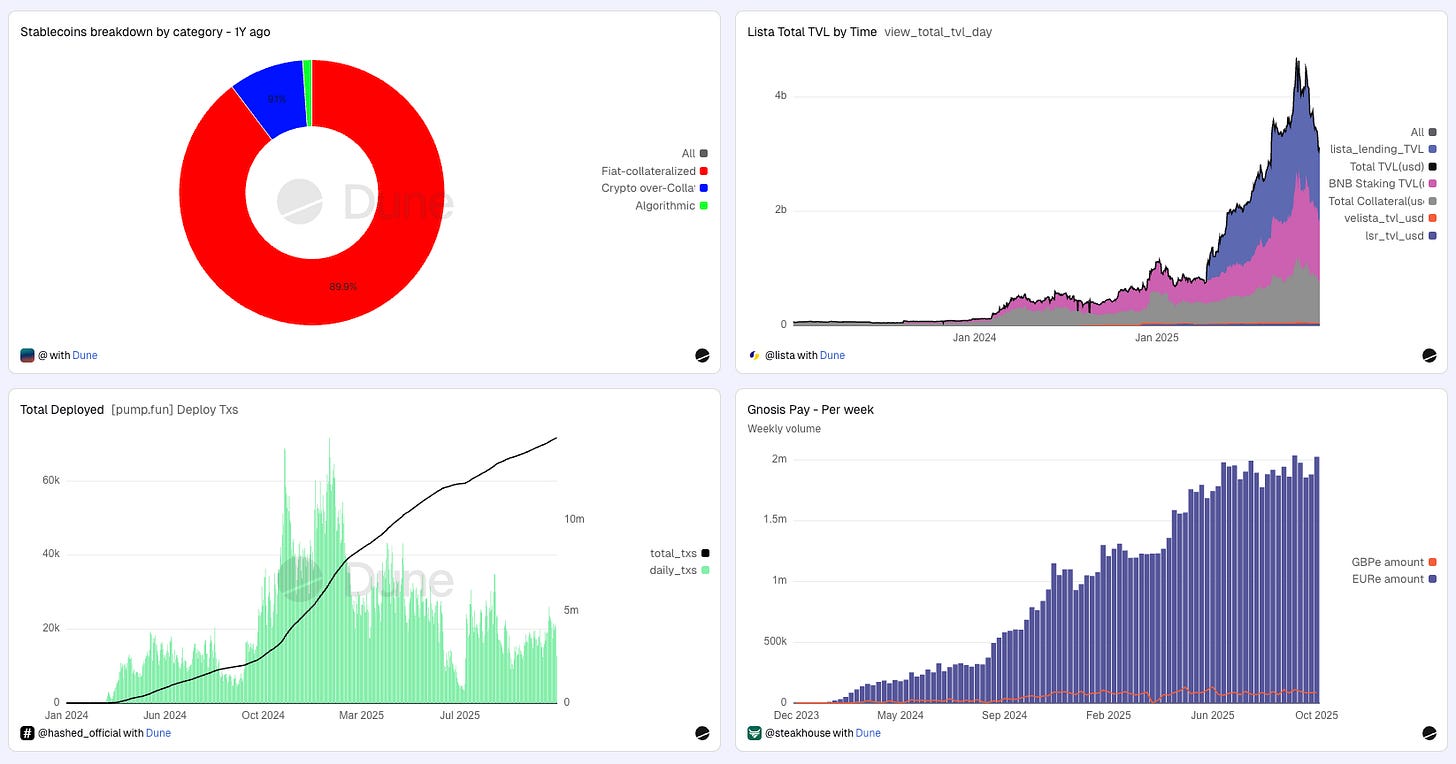

For more than a decade, blockchains have promised to “rebuild finance.” In practice, most of that energy was invested in speculation: trading tokens, farming yields, and minting NFTs. Meanwhile, the original promise—cheap, fast, global payments—never quite worked for businesses at scale.

As stated in the announcement article by Paradigm https://www.paradigm.xyz/2025/09/tempo-payments-first-blockchain

Stablecoins are quickly moving from the edges of crypto into the mainstream. As that happens, it’s becoming increasingly clear that most of today’s blockchain infrastructure isn’t well-suited for real-world payments.

Tempo exists because Stripe and Paradigm reached the same conclusion: payments are a fundamentally different problem than speculation, and they need different infrastructure.

Much of the existing crypto stack—by design or by accident—optimizes for trading. That’s a valuable use case, but it comes with tradeoffs: volatile fees, unpredictable performance, and infrastructure that works well for speculation but poorly for everyday financial activity.

Payments have very different requirements. They need to be fast, cheap, reliable, and easy to integrate into existing systems. Tempo exists because we believe stablecoins deserve infrastructure that is built for those needs from the ground up.

What is Tempo?

Tempo is a payments-first blockchain, purpose-built for stablecoins and real-world financial flows. It draws directly from Stripe’s experience operating global payments infrastructure at massive scale, combined with Paradigm’s work building and researching crypto protocols.

The goal is simple: create a chain that actually works for payments—not as a side effect, but as its primary function. Their involvement ensures that Tempo is shaped by real operational constraints, regulatory requirements, and user needs—not just theory.

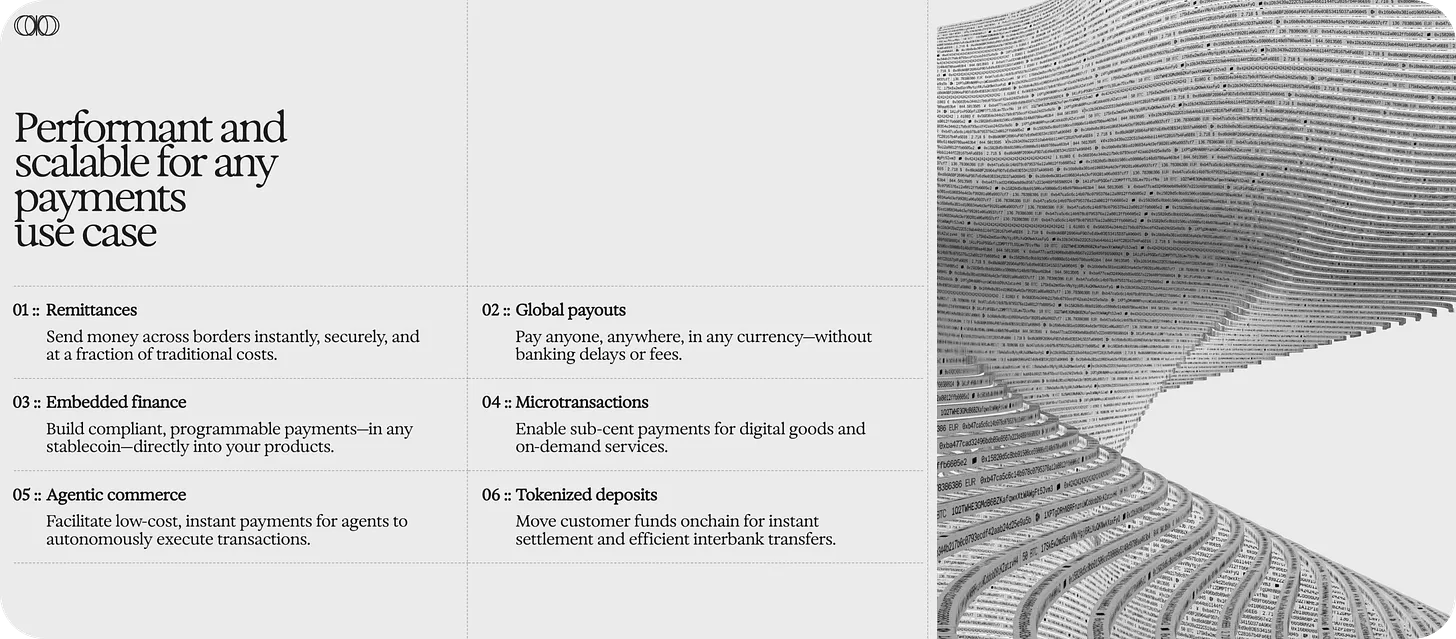

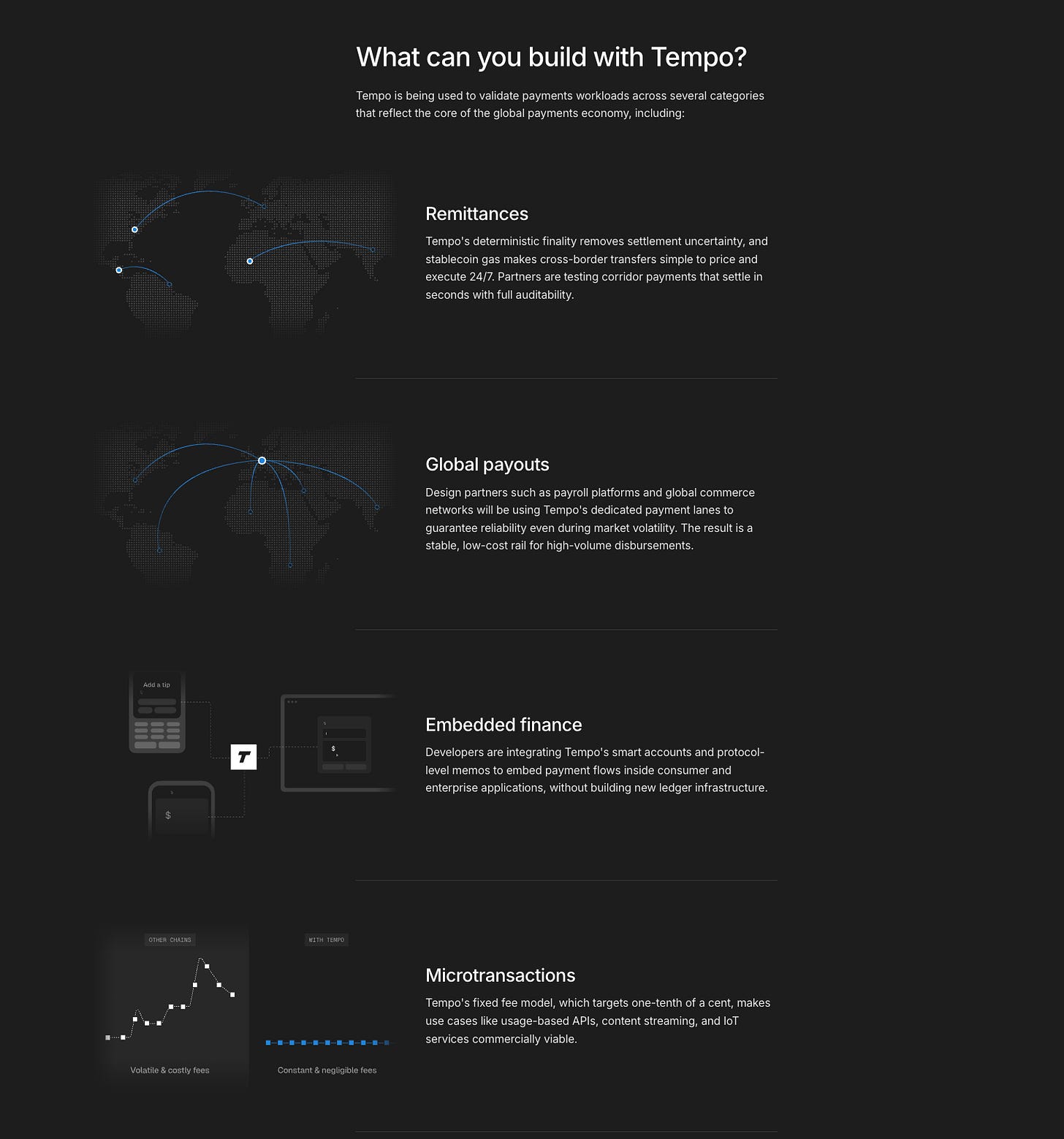

Tempo is designed to support a wide range of real-world use cases, including:

These are areas where stablecoins already show enormous promise—but where existing infrastructure often falls short.

Key Findings: Performance, Predictability, and Partnership Concentration

Analysis of Tempo’s design specifications and early ecosystem development reveals a highly focused and institutionally validated approach to market entry.

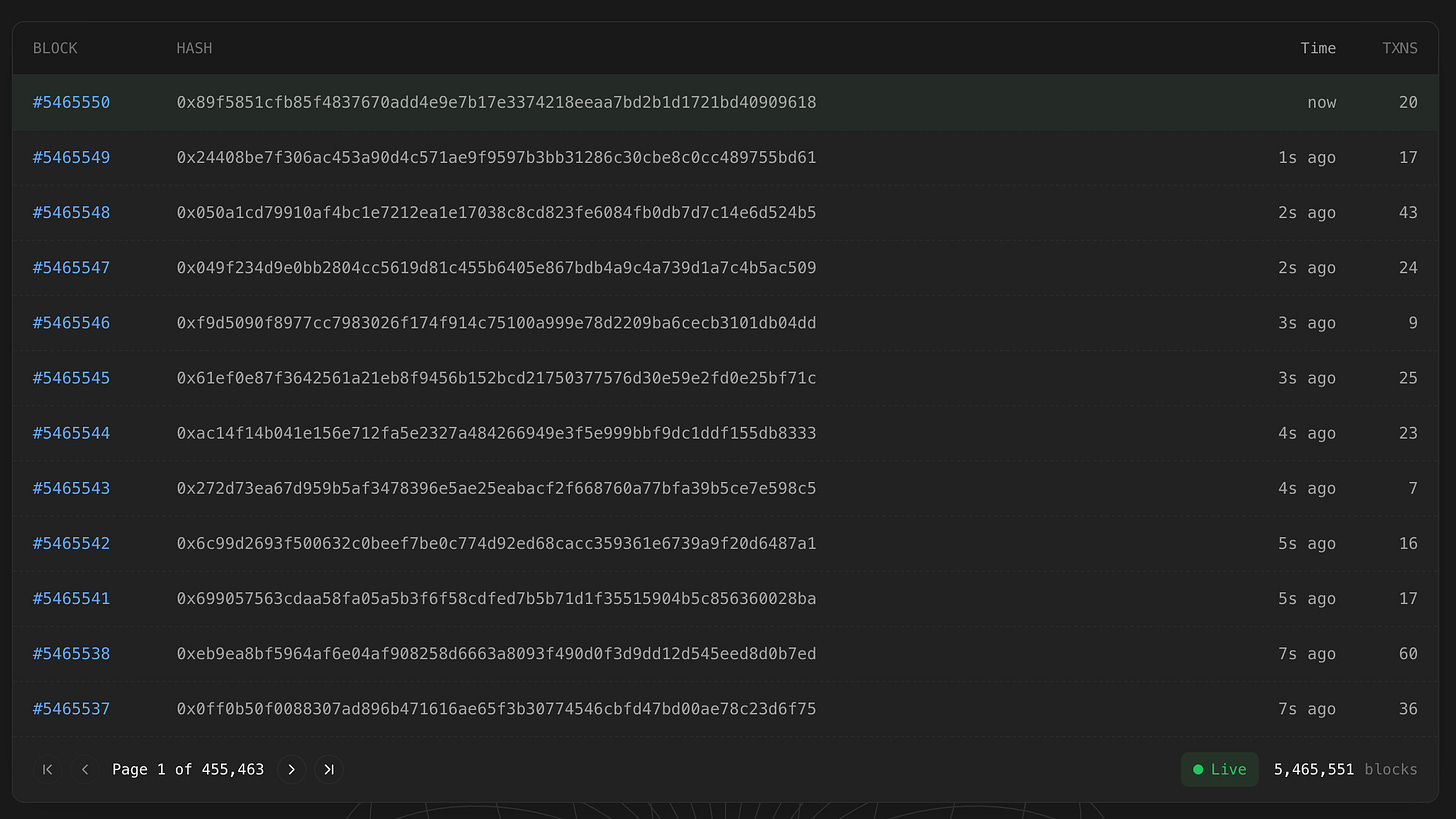

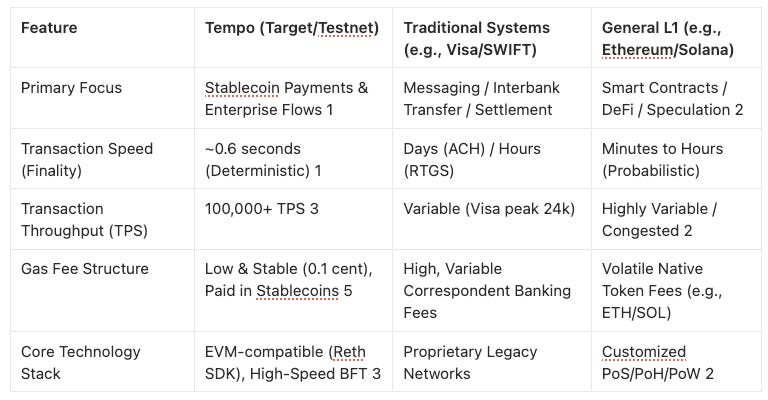

Tempo is engineered for elite performance, aiming for enterprise-grade throughput that directly rivals existing centralized payment networks. The targeted throughput exceeds 100,000 transactions per second (TPS), coupled with a commitment to deterministic finality in approximately 0.6 seconds. This sub-second, guaranteed settlement certainty is critical for integrating with existing financial systems that require immediate confirmation of funds transfer.

The platform achieves economic stability and predictability through several core protocol features. The implementation of dedicated payment lanes guarantees blockspace for payment transactions, insulating them from network spikes and ensuring low, stable transaction fees, targeting an efficient cost of one-tenth of a cent ($0.001) per transaction.

Furthermore, users pay fees directly in USD stablecoins, an approach known as stablecoin-native gas, which eliminates enterprise exposure to the price volatility of a separate, speculative native token.

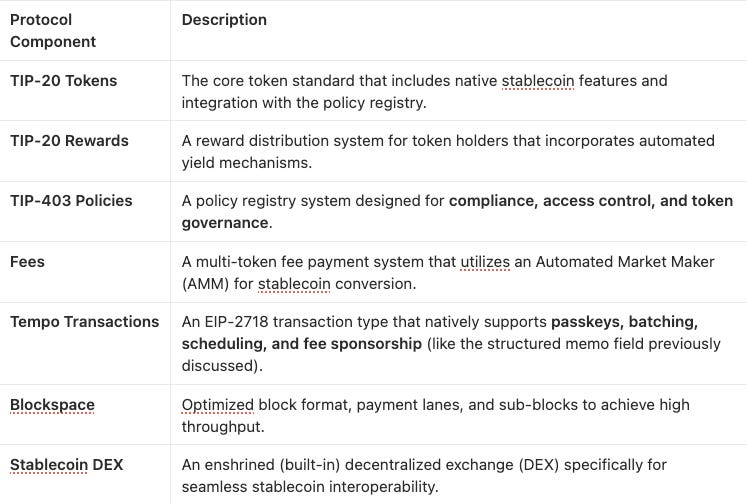

Protocol Specification

The Tempo protocol is a blockchain specifically purpose-built for global payments, making deliberate technical choices optimized for scale rather than functioning as a general-purpose platform.

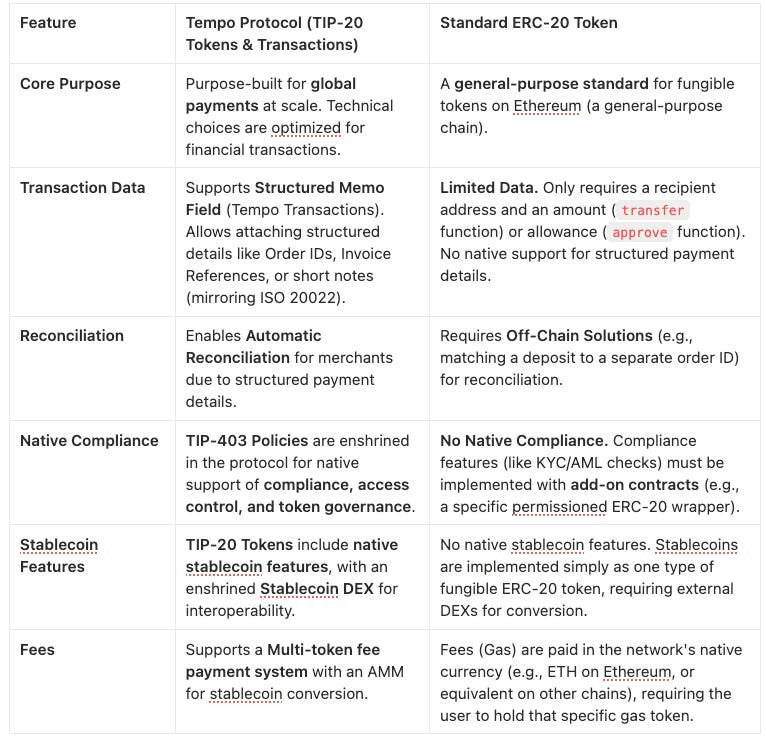

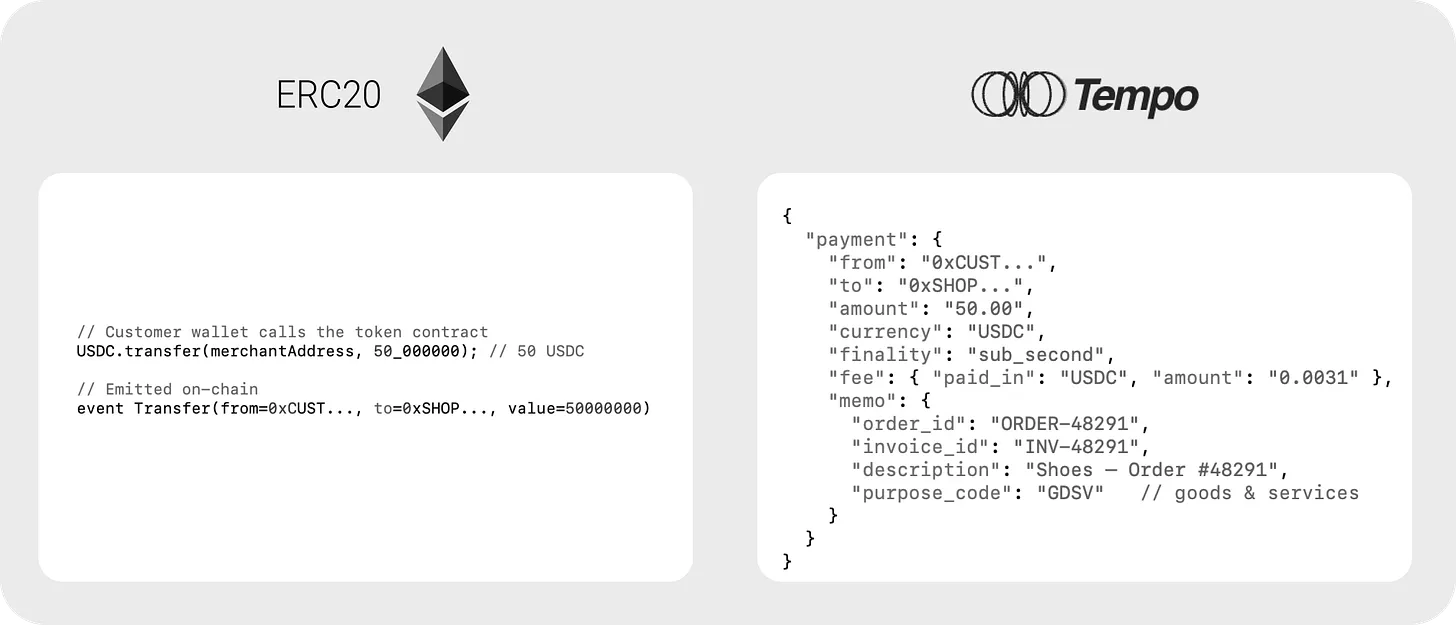

The Tempo protocol is designed to address the limitations of standard blockchain tokens like ERC-20, particularly in the context of global payments.

Consensus Mechanism: High-Speed Byzantine Fault Tolerance (BFT)

To achieve its speed and finality guarantees, Tempo employs a high-speed Byzantine Fault Tolerance (BFT) consensus mechanism for secure and rapid block creation. BFT protocols are typically favored in environments that require immediate finality and high transaction throughput, which are common characteristics of permissioned or enterprise-focused blockchains.

The implementation of BFT, particularly when coupled with an initially permissioned validator set, confirms Tempo’s deliberate prioritization of institutional requirements—namely speed, compliance control, and guaranteed finality—over the immediate pursuit of maximal retail decentralization. This calculated structural choice provides the operational assurance equivalent to a Real-Time Gross Settlement (RTGS) system, which is a necessary prerequisite for integrating high-value traditional banking assets like tokenized deposits.

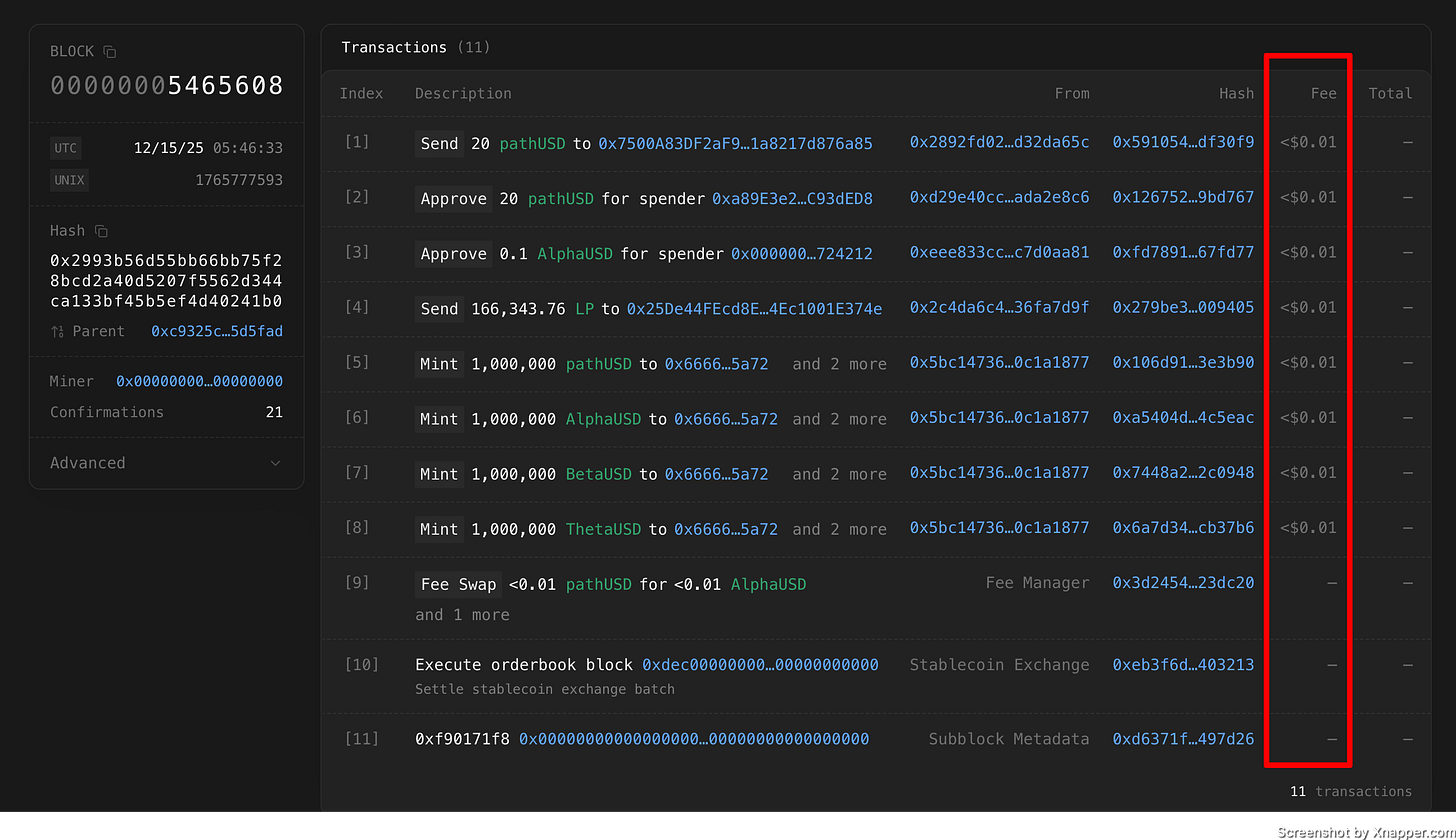

The table below summarizes Tempo’s target performance against established payment systems:

Structured Memo Field

Unlike standard ERC-20 transfers, which only show the transfer address and amount, Tempo allows structured details to be attached directly to the payment. These details can include items like order IDs, invoice references, or short descriptive notes, mirroring the globally adopted ISO 20022 format used by banks.

This functionality offers significant benefits:

For Merchants: It enables automatic reconciliation of payments.

For Customers: It provides clear receipts displayed within their crypto wallets.

Essentially, Tempo transforms a typical crypto transfer into a proper, comprehensive payment message.

Ecosystem Partners

Design partners are companies that help shape the system before it exists at scale. They bring real requirements, constraints, and feedback into the protocol itself. This approach is slower and more demanding, but it produces infrastructure that works in practice, not just in theory.

Tempo’s design partners span AI, commerce, fintech, and traditional financial services, including Anthropic, Coupang, Deutsche Bank, DoorDash, Lead Bank, Mercury, Nubank, OpenAI, Revolut, Shopify, Standard Chartered, Visa, and others.

Each of these organizations engages with payments in a different way:

Banks care about settlement finality, compliance, and liquidity management.

Fintechs care about cost predictability, integration, and scale.

Commerce platforms care about reliability and user experience.

AI companies care about microtransactions, automation, and machine-driven payments.

By involving all of them early, Tempo is being shaped to support the full spectrum of real-world payment flows—not just one narrow use case.

Tempo represents a necessary evolution in blockchain technology, moving the industry beyond generalized, speculative protocols toward specialized, highly reliable financial infrastructure. The project’s genesis—jointly incubated by Stripe, which requires massive scale and compliance for its commerce flows, and Paradigm, which provides cutting-edge Web3 technical expertise—establishes an exceptionally robust foundation.

The decision to launch in 2026, following a rigorous testing schedule, reflects a strategic adherence to the high-assurance standards of traditional finance. By prioritizing performance, compliance, and cost predictability over rapid deployment or speculative tokenomics, Tempo is strategically positioned to become the definitive infrastructure layer upon which institutional stablecoin payments and tokenized deposits are executed globally. The success of Tempo will not be measured in the appreciation of a native asset, but in its ability to process trillions of dollars in real-world economic activity with unprecedented speed and efficiency.