Prediction Markets: The New Infrastructure of Truth

In a world where information is infinite but trust is scarce, prediction markets are quietly emerging as the internet’s most reliable truth engine.

Traditional forecasting systems — political polls, expert panels, even algorithmic models — often struggle with bias, lag, or selective sampling. But prediction markets flip the logic: they turn conviction into capital, and capital into computation.

When the Intercontinental Exchange (ICE), parent of the New York Stock Exchange, announced a $2 billion investment in Polymarket, it marked a turning point. What started as a crypto-native experiment is now becoming a financial data infrastructure — a system where the global crowd, not centralized institutions, sets the odds of the future.

In 2020, Polymarket founder Shayne Coplan had a conviction: that markets could outperform pundits in predicting real-world outcomes. For five years, he built quietly, iterating through regulatory setbacks and liquidity droughts.

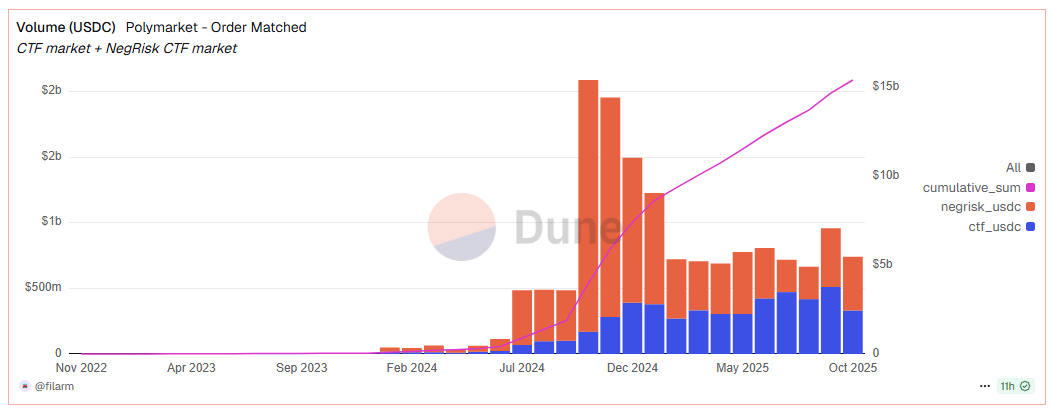

Then, July 2024 changed everything.

When a failed assassination attempt on former U.S. President Donald Trump and President Biden’s campaign withdrawal reshaped global politics, Polymarket’s volumes exploded. For the first time, people from over 100 countries were trading political probabilities via this event, a global referendum powered by crypto rails.

Unlike a poll that asks, “Who do you support?”, prediction markets ask, “What outcome will you stake your money on?”

And that difference changes everything: it turns belief into measurable signal.

Polymarket Resolves U.S. Presidential Election Market After $3.6 Billion Volume

This wasn’t just an equity deal. It was institutional capital validating the onchain model — signaling that traditional markets see DeFi rails not as competitors, but as the next evolution of financial data systems.

ICE’s move effectively bridged Wall Street liquidity into decentralized infrastructure, opening the door for other institutions — from hedge funds to data providers — to explore how blockchain-based truth markets could power new forms of risk modeling, policy forecasting, and alternative data trading.

Polymarket’s journey from startup to institutional magnet mirrors crypto’s broader transition: from speculative playgrounds to infrastructure that legacy finance now needs.

Following Polymarket’s rise, a new wave of platforms has emerged — each blending prediction mechanics with on-chain liquidity, composability, and user experience to capture this momentum.

Kalshi — Regulated, Institutional, and Expanding On-chain

Founded in 2021, Kalshi took the opposite route from Polymarket.

Rather than operating permissionlessly, it became the first CFTC-regulated U.S. prediction exchange, proving that event-based trading could fit inside the walls of traditional finance.

But after Polymarket’s explosion, even Kalshi began pivoting toward crypto via hiring John Wang as Head of Crypto as the first step.

Valuation: $5B (post–$300M raise, 2025)

Volume: $1.4B monthly

Institutional Market Share: 60% of U.S. event-trading volume

https://x.com/Kalshi/status/1968307024799879505

Kalshi: Partnered with Pyth Network to publish live event probabilities across 100+ blockchains — turning regulated forecasts into composable onchain data feeds.

This move was more than a technical integration; it was a recognition that the next frontier of prediction markets won’t live behind paywalls or APIs — it will live onchain, transparent, programmable, and open to builders.

Myriad Markets — Decentralized, Multichain, and Builder-Led

Meanwhile, Myriad Markets, launched in 2025 by DASTAN (the team behind Decrypt and Rug Radio), took Polymarket’s ethos and pushed it fully into the Web3 stack.

Built for permissionless participation, it runs natively on Abstract, Linea, and Celo, with expansions planned for EigenLayer.

Volume: $20M+ USDC, 5M+ trades, 500K users

Innovation: Chrome extension trading, $MYR token incentives, AI-assisted prediction bots

Philosophy: Build markets like protocols, not products.

Where Kalshi connects institutions to DeFi, Myriad connects communities to conviction — making prediction markets part of daily onchain life.

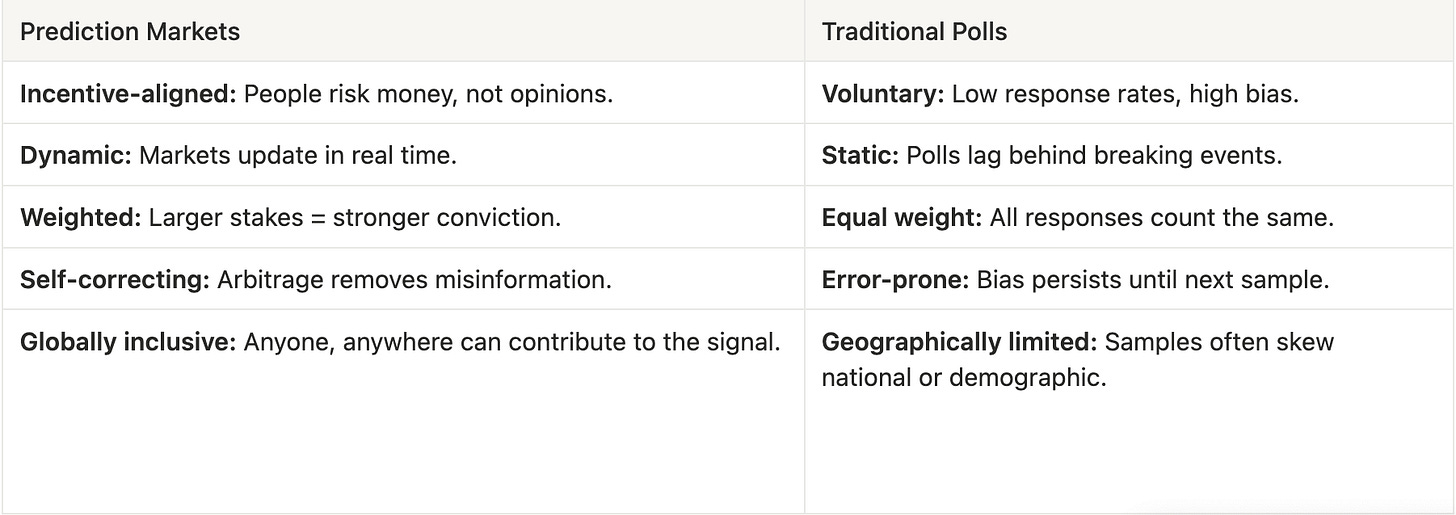

How Prediction Markets Work — and Why They’re Smarter Than Polls

At their core, prediction markets are information aggregation systems — economic computers that convert human belief into quantifiable probabilities.

Every trade, every price, and every correction represents millions of micro-decisions made by people acting on their own fragments of knowledge.

Mechanism in Motion

It starts when a user creates a clear, verifiable question — something that can be proven true or false later, such as “Will Bitcoin exceed $100K by December?” or “Will a certain candidate win the election?”

The event must be objective so the network can confirm it without dispute.

That question becomes a tokenized market with two outcomes: Yes and No.

Each is priced between $0 and $1, representing the crowd’s belief.

If “Yes” trades at $0.65, it implies a 65% chance of the event occurring.

These outcome tokens are freely tradable across the network like any other onchain asset.

As trading begins, users buy or sell based on their conviction.

If they think the market underestimates the odds, they buy “Yes”; if not, they sell.

Every trade refines the collective probability, as new data, news, or sentiment instantly shifts prices.

The more participants there are, the sharper and more accurate the forecast becomes.

Behind the interface, smart contracts handle everything automatically — issuing tokens, recording trades, holding collateral, and distributing payouts once the market resolves.

They act as neutral referees, enforcing the rules transparently and without intermediaries.

When the event concludes, oracles verify the real-world result and feed it onchain.

Once confirmed, the smart contract settles instantly: holders of the correct outcome receive $1 per share, while the others expire at zero.

The beauty of this design lies in how markets outperform experts, not by knowing more, but by integrating more.

Traditional forecasting depends on concentrated expertise — analysts, polling firms, or institutional models. These systems are hierarchical by nature: insight flows from the few to the many.

Prediction markets invert that structure.

They harness distributed conviction, where every trader, no matter how small, becomes part of a collective feedback loop that constantly prices new information.

As liquidity deepens, accuracy compounds.

Each trade nudges the market closer to equilibrium, absorbing new data, correcting false narratives, and translating scattered intuition into quantified consensus.

The power of prediction markets isn’t that they eliminate human bias — it’s that they crowdsource its correction.

With crypto, prediction markets scale beyond borders. Anyone, anywhere can create or trade on events — from global elections to sports outcomes or token prices — all verified and settled onchain. This openness draws data from a far larger and more diverse crowd than any traditional market or poll, turning billions of micro-opinions into live, global probabilities. The result is a system that doesn’t just forecast outcomes — it captures how the entire world feels about them in real time.

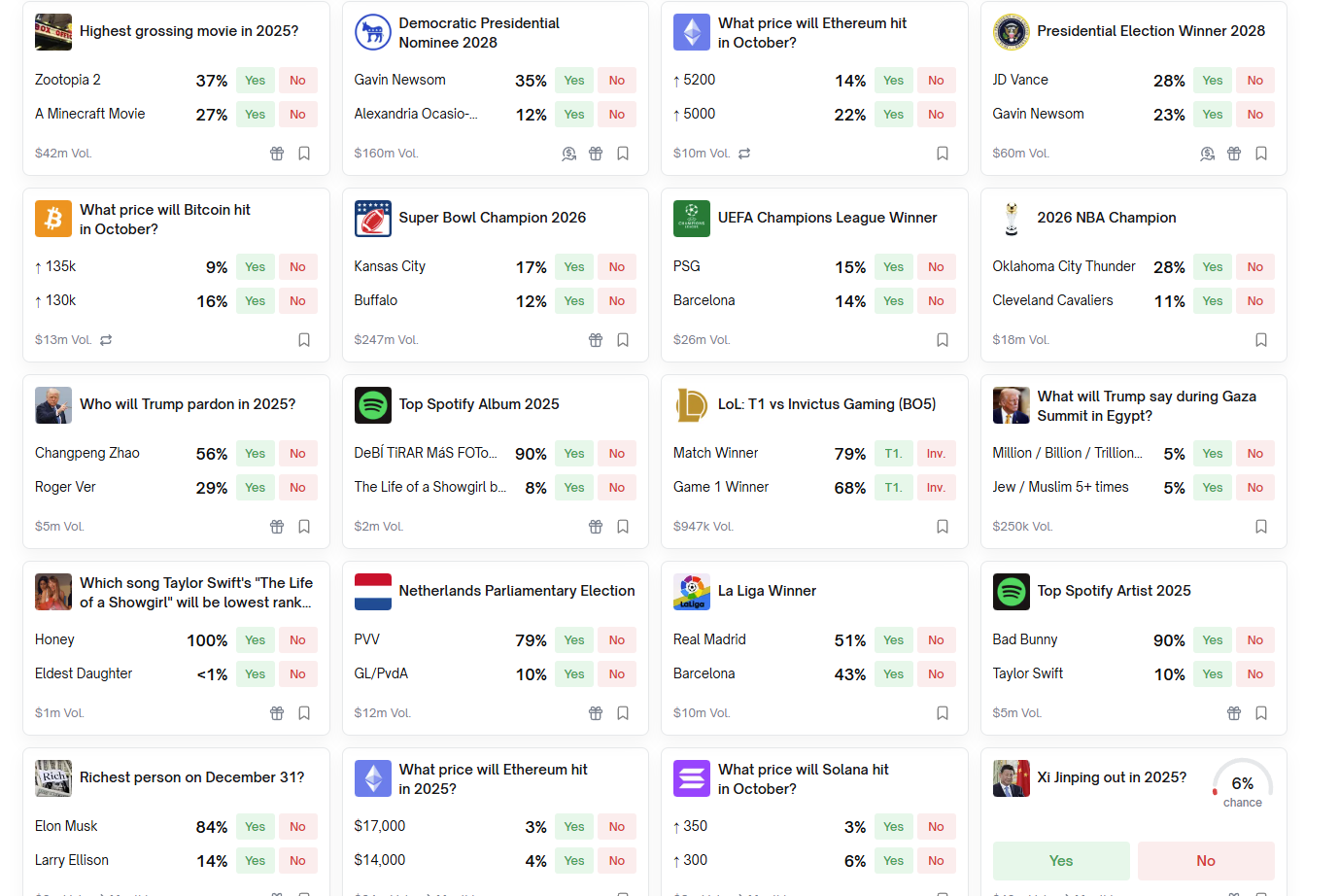

What’s Next for Prediction Market?

Mainstream Adoption

News consumption is changing. What used to be passive scrolling has turned into active participation — audiences don’t just read headlines anymore; they trade on them.

Prediction markets capture this shift perfectly. They merge the culture of engagement with the structure of finance, giving people a way to act on conviction instead of just commenting on it.

From “Google it” → “Polymarket it”

In 2025, Polymarket became a cultural shorthand — the place where people check probabilities before checking opinions.

NFL legend Tom Brady joked on X, “Check the Polymarket,” while South Park aired an episode explaining prediction markets as “peer-to-peer betting” — a moment that marked their entry into mainstream consciousness.

These viral moments show that prediction markets are no longer confined to DeFi circles. They’ve crossed into everyday language, where markets are becoming the new media.

Builders Are Already Experimenting

Across crypto, developers are pushing prediction markets far beyond speculation:

Lending with conviction: Using Polymarket positions as collateral in DeFi loans.

Social trading bots: Integrating market odds into Telegram and X.

Forecast dashboards: “Bloomberg for Prediction” tools built on Myriad and Pyth.

Modular integrations: Protocols using event data for insurance, governance, or tokenomics triggers.

In this sense, prediction markets aren’t just apps — they’re an economic infrastructure for uncertainty.

In the next few years, prediction markets are poised to become a core layer of crypto infrastructure — sitting alongside AMMs, stablecoins, and oracles as part of the base toolkit for decentralized systems.

They won’t just reflect sentiment — they’ll help generate and direct it.

We’re already seeing the early signs:

DeFi protocols are beginning to integrate market probabilities into risk models.

Media outlets referencing prediction data alongside polls and analytics.

Institutional traders using event markets to hedge political or macro risk.

As more liquidity and builders enter the space, these markets will evolve from simple betting venues into information engines that feed the entire ecosystem — from governance and pricing to reputation and coordination.

Markets, in this sense, are becoming the collective feedback loop of the crypto economy — a way to measure conviction, verify consensus, and navigate uncertainty in real time.

In a world flooded with speculation and noise, prediction markets bring something different: clarity priced in truth.

Closing

Prediction markets are becoming the connective tissue between information and value — a place where belief is priced and accuracy is rewarded.

They turn speculation into structure, transforming how we understand what’s true.

In the noise of the modern world, they offer something simple but powerful.

Market everything!